Launching a business? Navigate the complexities of LLCs and S Corps with confidence using "LLC & S Corp Beginner's All-in-One Guide." This comprehensive guide from Finance Knights Publications provides a step-by-step approach to forming and managing either structure, even without prior experience. Learn to protect your personal assets, optimize taxes, and avoid costly mistakes. Master essential documents, understand tax regulations, and develop growth strategies. The book includes free downloadable templates, checklists, and four bonus e-books covering topics like IRS audits and business credit. Whether you're choosing between LLC and S Corp structures or planning for long-term success, this guide empowers you to build a thriving and legally sound business.

Review LLC & S Corp Beginner’s All-in-One Guide

This "LLC & S Corp Beginner’s All-in-One Guide" is a fantastic resource, and I wholeheartedly recommend it to anyone venturing into the world of business ownership. Frankly, I was initially intimidated by the prospect of navigating the complexities of LLCs and S Corps; the legal jargon, tax implications, and asset protection strategies seemed overwhelming. This book, however, completely changed my perspective.

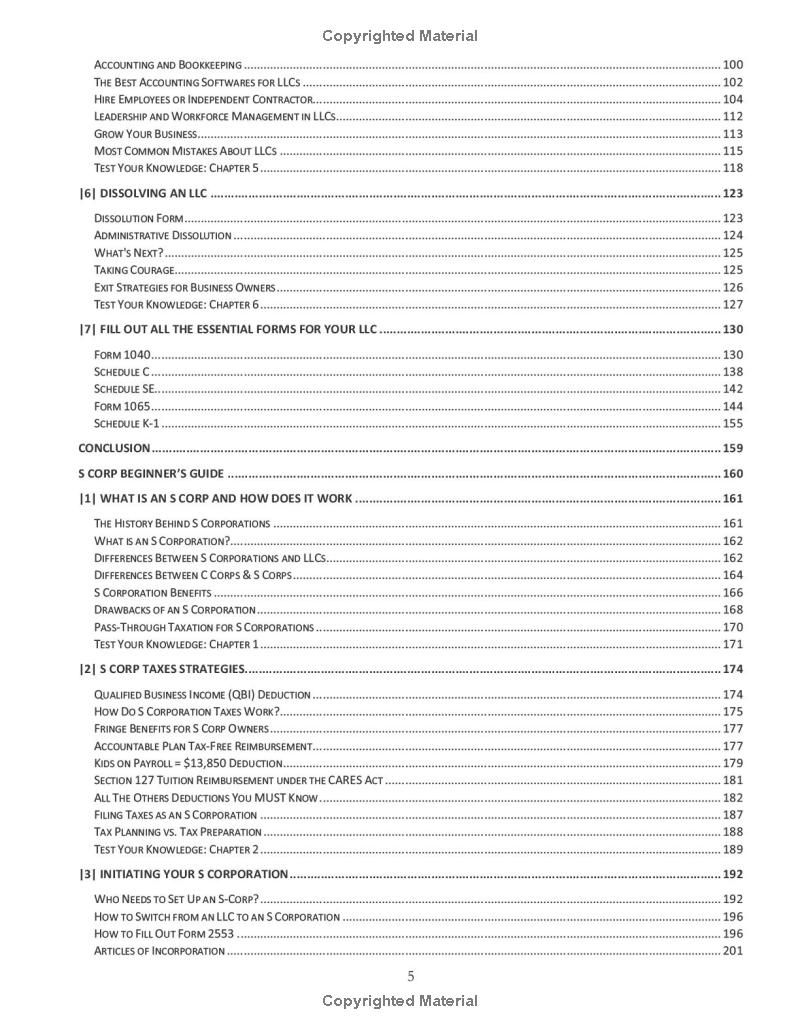

What sets this guide apart is its remarkable ability to simplify complex concepts. Finance Knights Publications has done an exceptional job of breaking down potentially daunting topics into easily digestible chunks. The step-by-step instructions for forming both an LLC and an S Corp are incredibly clear and well-organized. I particularly appreciated the inclusion of free templates for essential documents like Articles of Organization and Operating Agreements – this saved me countless hours of research and potential frustration.

The book doesn't just focus on the initial formation process; it provides ongoing guidance for managing your business effectively. The sections on taxation are particularly helpful, offering practical advice on maximizing deductions and ensuring compliance with IRS regulations. I found the explanations of various IRS forms incredibly useful, and the simplified approach significantly reduced my anxiety around tax season. Similarly, the chapters on asset protection are invaluable, outlining strategies to shield personal assets from potential business liabilities – a crucial aspect often overlooked by beginners.

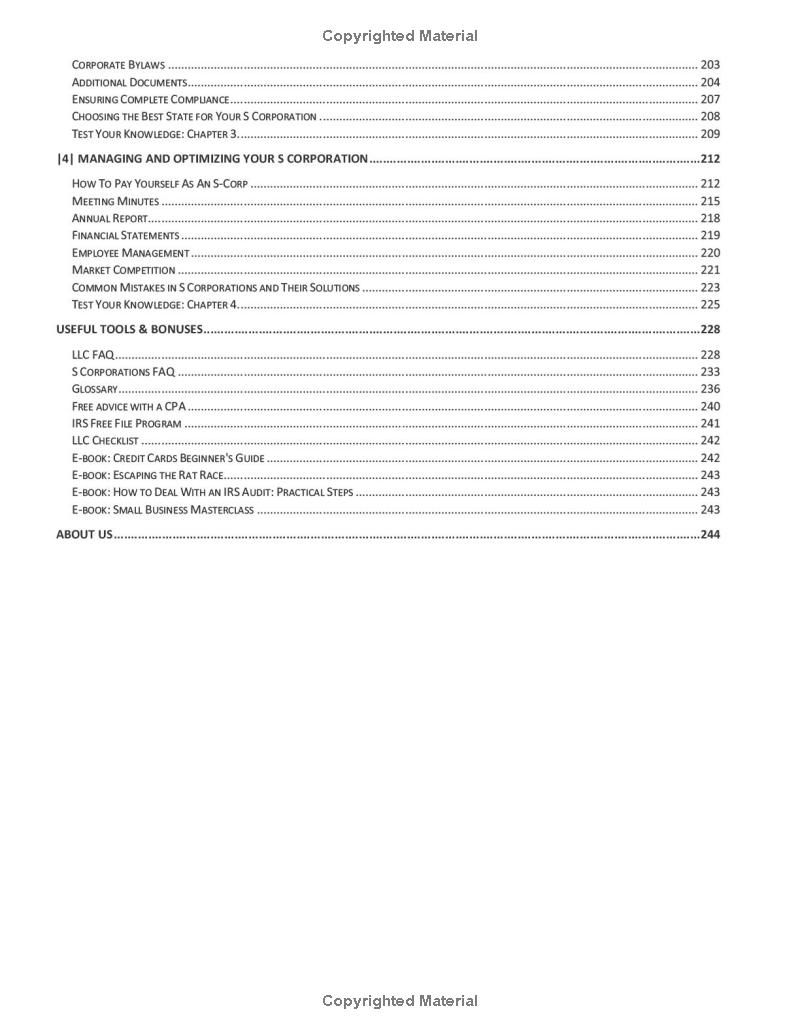

Beyond the core content, the inclusion of bonus materials is a significant advantage. The checklists, e-books on topics like IRS audits and business credit cards, and even a small business masterclass add considerable value. These supplemental resources provide a holistic approach to business management, extending far beyond the basics of LLC and S Corp formation. The quality of these bonuses is surprisingly high; they aren't just filler content, but rather insightful and practical guides in their own right.

The authors clearly understand the challenges faced by new entrepreneurs. The book addresses common mistakes and pitfalls, offering valuable insights to avoid costly errors and ensure long-term stability. The focus on future planning, including exit strategies, demonstrates a forward-thinking approach, something often lacking in similar guides. The advice on managing employees and payroll, while brief, is spot-on and extremely helpful for those considering hiring.

In short, this "LLC & S Corp Beginner’s All-in-One Guide" is much more than just a book; it's a comprehensive business toolkit. It provides the knowledge, practical tools, and confidence needed to launch and manage a successful LLC or S Corp. Whether you're a complete novice or seeking to refine your existing business structure, this guide will undoubtedly prove to be an invaluable asset on your entrepreneurial journey. The friendly tone and easy-to-follow style make it accessible to everyone, regardless of their prior experience. It’s a truly exceptional resource, and I highly recommend investing in it.

Information

- Dimensions: 8.5 x 0.56 x 11 inches

- Language: English

- Print length: 246

- Publication date: 2024

Preview Book